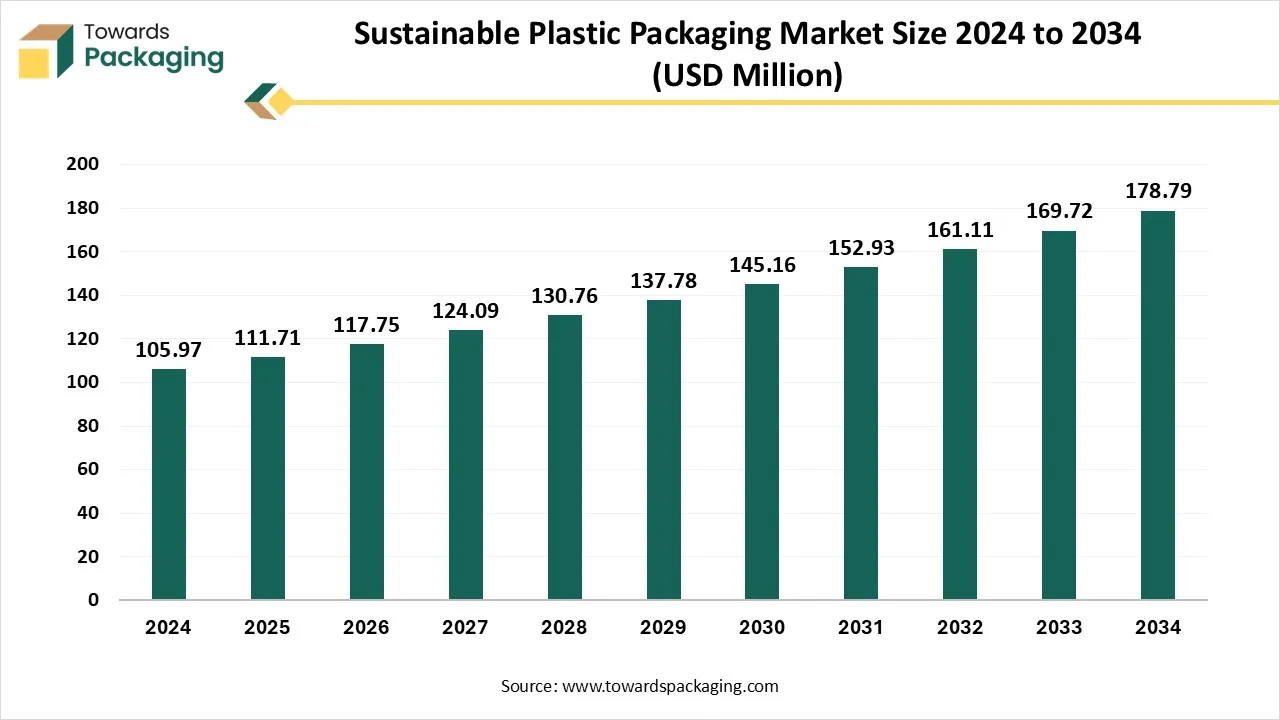

Sustainable Plastic Packaging Market to Expand at 5.43% CAGR and 6 Major Segments to Watch

The global sustainable plastic packaging market valued at USD 105.97 billion in 2024 and is anticipated to reach USD 178.79 billion by 2034, growing at a CAGR of 5.43% over the next decade.

Ottawa, June 30, 2025 (GLOBE NEWSWIRE) -- According to Towards Packaging experts, the sustainable plastic packaging market is expected to grow from USD 111.71 billion in 2025 to USD 178.79 billion by 2034, reflecting a CAGR of 5.43%. A study published by Towards Packaging a sister firm of Precedence Research.

The sustainable plastic packaging market is driven by growing environmental concerns, government regulations, and shifting consumer preferences toward eco-friendly products. Brands are increasingly adopting biodegradable, recyclable, and reusable plastic solutions to meet sustainability goals and reduce carbon footprints. Innovation in materials such as bioplastics and post-consumer recycled plastics is enhancing performance and reducing waste.

Stringent regulations, especially in Europe and North America, are accelerating industry transformation. The food and beverage, personal care, and healthcare sectors are major adopters due to the rising demand for sustainable and safe packaging. Circular economy initiatives and corporate ESG commitments continue to support market expansion.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5617

What is Sustainable Plastic Packaging?

Sustainable plastic packaging refers to packaging solutions made from plastic materials that are designed to minimize environmental impact throughout their lifecycle. This includes reducing resource consumption, promoting recyclability, and lowering carbon emissions. Sustainable plastic packaging may involve:

- Recyclable plastics that can be collected and reprocessed into new products.

- Biodegradable or compostable plastics that break down naturally under specific conditions.

- Reused or refillable packaging that reduces single-use waste.

- Plastics made from renewable or recycled materials (e.g., bio-based or post-consumer recycled content)

The goal is to support a circular economy by reducing plastic pollution while maintaining packaging functionality, safety, and efficiency.

Key Sustainability Initiatives Enacted in 2025 Across Different Countries

Europe

- Germany is rolling out a plastic tax in 2025, targeting hard-to-recycle single-use items like food containers and grocery bags.

- Switzerland launched a nationwide recycling scheme (Recypac) to improve household plastic and drinks carton recycling, aiming for 55% plastic packaging recovery by 2030.

Asia-Pacific

- Japan is enforcing PFAS restrictions in food packaging starting in 2025, and moving to ensure all plastics used are recyclable by year-end.

- Australia continues its National Packaging Targets: by 2025, 100% of packaging must be reusable, recyclable, or compostable, with mandatory EPR and PFAS bans.

- South Korea (Jeju Province) launched the “Plastic Zero Island” campaign (via World Environment Day), phasing out single-use plastics and introducing deposit-return schemes toward a 2040 plastic-free goal.

- Andhra Pradesh State in India relaunched its anti-plastic drive in mid-2025, banning single-use items in major cities, subsidizing women-led biodegradable goods, and incentivizing retailers and consumers.

- Marico (India) introduced a Packaging Circularity Score Framework on World Environment Day 2025, committing to >30% recycled content in non-food plastics by 2030.

North America

- New York State is advancing the Packaging Reduction and Recycling Infrastructure Act, mandating a 30% reduction in plastic packaging, recyclability improvements, and corporate recycling plans, all pending Assembly approval.

Middle East

- Saudi Arabia, via its Vision 2030 and the Green Initiative, reaffirmed commitments on World Environment Day 2025, launching coordinated campaigns to reduce plastic pollution and promote ecosystem restoration.

Explore Strategic Figures & Forecasts – Access the Databook Now: https://www.towardspackaging.com/download-databook/5617

What are the Major Trends in the Sustainable Plastic Packaging Market?

- Shift Toward Recyclable and Mono-Material Packaging

Companies are replacing complex multi-layer plastic structures with mono-material films (e.g., all-polyethylene or all-polypropylene), which are easier to recycle and meet circular economy goals.

- Growth of Post-Consumer Recycled (PCR) Content

Use of recycled plastics, especially rPET and rHDPE, is surging as brands and regulators push for higher recycled content in packaging to reduce virgin plastic usage.

- Rise of Compostable and Biodegradable Plastics

Materials like PLA (polylactic acid), PHA, and starch-based bioplastics are gaining popularity, especially for food service packaging, due to their lower environmental impact and compliance with waste regulations.

- Increased Adoption of Reusable and Refillable Packaging Models

Brands and retailers are investing in refill stations, reusable containers, and closed-loop delivery systems to cut down on single-use plastics.

- Extended Producer Responsibility (EPR) Compliance

Governments are enforcing EPR laws, making producers responsible for the post-consumer lifecycle of packaging. This is pushing companies to design for recyclability and fund collection systems.

- Digital Tracking and Smart Packaging

Technologies like QR codes, RFID, and blockchain are being integrated into packaging to improve traceability, recycling efficiency, and consumer engagement with disposal and reuse.

- Ban on Harmful Substances

Regulatory restrictions on per- and polyfluoroalkyl substances (PFAS) and other toxic additives are influencing material choices and driving innovation in safer alternatives.

- Retail and Consumer-Led Sustainability Demand

Consumers are actively choosing brands with eco-labels, minimal packaging, or plastic-free alternatives, pushing companies to visibly commit to sustainable practices.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What is the Potential Growth Rate of Sustainable Plastic Packaging?

Rising Environmental Awareness and Innovation in Materials and Technologies

Increasing concern over plastic pollution is prompting consumers and governments to demand eco-friendly alternatives, creating strong market potential for sustainable packaging solutions. Emerging materials like bioplastics, PHA, and compostable films, and technologies such as chemical recycling and advanced barrier coatings, are enabling broader use of sustainable packaging across industries. Major global brands are committing to using 100% recyclable or reusable packaging by 2025–2030, driving consistent demand for sustainable plastic alternatives. Increased focus on closed-loop systems, reuse models, and refillable packaging presents innovation opportunities and long-term revenue streams.

- In February 2025, the French-Asian bakery café company TOUS les JOURRS (TL) started distributing new eco-friendly, plant-based plastic straws to its stores across the U.S. CJ BMS initiated the development of a novel biobased PHA molecule that might satisfy marine biodegradability and compostability certifications. CJ BMS introduced PHAT CB0400A in 2024. This PHA compound is composed of a special graded of amorphous and semi-crystalline PHA biopolymers.

Limitations and Challenges in the Sustainable Plastic Packaging Market:

Limited Infrastructure and Performance Limitations

The key players operating in the market are facing issues due to limited infrastructure and performance limitations, which are estimated to restrict the growth of the market. Some sustainable materials may not offer the same barrier properties, strength, or longevity as conventional plastics. Switching to sustainable materials can require changes in manufacturing equipment, which can increase operational costs.

Regional Analysis:

Who is the leader in sustainable packaging?

The Asia Pacific region held the largest share of the sustainable plastic packaging market in 2024, owing to a large and growing consumer base. Countries like India, China, Indonesia, and Thailand have implemented or strengthened single-use plastic bans, recycling mandates, and Extended Producer Responsibility (EPR) programs, pushing industries toward eco-friendly packaging alternatives. The Asia Pacific region is a global manufacturing center for electronics, textiles, and consumer goods, where sustainable packaging is increasingly required by export markets, especially Europe and North America.

Multinational companies operating in Asia Pacific are adopting green packaging strategies to align with global ESG goals and regional consumer preferences for eco-conscious brands. For instance, Thailand has an action plan, “Roadmap on Plastic Waste Management (2018–2030),” targeting a complete phaseout of problematic plastics.

India Market Trends

India's sustainable plastic packaging market is driven by the strict government regulations. The government regulation in India like a ban on identified single-use plastics since 2022, expanded enforcement and incentives in 2025. Launch of EPR mandates, subsidies for biodegradable material manufacturers, and corporate zero-waste targets.

China Market Trends

China's sustainable plastic packaging market is driven by the robust manufacturing infrastructure in the country. Massive investments in bioplastics, chemical recycling, and green packaging materials in China drive the market growth. China has imposed strong policy support for recycling, green product design, and producer responsibility.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

How is the Opportunistic Rise of North America in the Sustainable Plastic Packaging Market?

North America is experiencing rapid growth in the sustainable plastic packaging market due to stringent environmental regulations, strong consumer demand for eco-friendly products, and corporate sustainability commitments. Government initiatives like Extended Producer Responsibility (EPR) laws and plastic reduction mandates in states like California and New York are driving industry-wide changes. Major brands are adopting recyclable, compostable, and reusable packaging to meet ESG goals and regulatory compliance.

Advanced recycling technologies, such as chemical recycling and smart packaging innovations, are enhancing efficiency and circularity. Additionally, heightened awareness of plastic pollution is encouraging investments in green packaging solutions across the food, beverage, and retail sectors.

U.S. Market Trends

The U.S. sustainable plastic packaging market is driven by the corporate sustainability goals in the country. States like California, New York, Oregon, and Washington are leading with plastic bans, recycled content mandates, and EPR regulations. Major U.S.-based companies (e.g., Coca-Cola, PepsiCo, Amazon, Procter and Gamble) are committing to 100% recyclable or compostable packaging by 2025–2030. Heavy investment in advanced recycling technologies, including chemical recycling, bioplastics, and AI-enabled sorting. Strong demand from environmentally conscious consumers is driving rapid shifts across retail, e-commerce, and food service packaging.

Canada Market Trends

Canada's sustainable plastic packaging market is driven by the federal policy initiatives in the country. Canada banned certain single-use plastics in 2022 and is implementing a Zero Plastic Waste initiative with recycled content requirements for plastic packaging starting in 2025. Nationwide EPR programs are being standardized, making producers financially responsible for post-consumer packaging waste. Government grants and public-private partnerships are promoting biodegradable materials, recycling infrastructure, and sustainable product design. High levels of environmental consciousness and community recycling participation support market growth.

How Big is the Success of the European Sustainable Plastic Packaging Market?

Europe is witnessing notable growth in the sustainable plastic packaging market due to a combination of strict environmental regulations, strong circular economy policies, and high consumer awareness. The European Union’s Green Deal, Circular Economy Action Plan, and Single-Use Plastics Directive mandate reduced plastic use, increased recycling, and minimum recycled content in packaging. Extended Producer Responsibility (EPR) schemes and plastic taxes are pushing brands to adopt recyclable, compostable, or reusable packaging. Additionally, European consumers are highly eco-conscious, driving demand for sustainable products. Investments in bioplastics, advanced recycling, and innovative packaging designs further support Europe's momentum in sustainable packaging adoption.

How Crucial is the Role of Latin America in Sustainable Plastic Packaging?

Latin America is experiencing growing demand for sustainable plastic packaging due to increasing environmental awareness, urbanization, and pressure to reduce plastic waste. Countries like Brazil, Chile, and Colombia have introduced plastic bag bans, EPR policies, and recycling mandates. Regional governments are partnering with NGOs and global companies to improve waste collection and promote eco-friendly materials. The food and beverage industry's shift toward recyclable and biodegradable packaging also supports market growth. Additionally, rising consumer preference for green products and increased foreign investment in sustainable packaging technologies are accelerating market adoption.

How does the Middle East and Africa lead the Sustainable Plastic Packaging Market?

The Middle East is gradually embracing sustainable plastic packaging, driven by national sustainability agendas like the UAE Vision 2030 and Saudi Arabia’s Vision 2030. These initiatives include goals for waste reduction, circular economy development, and bans on certain single-use plastics. Countries such as the UAE, Saudi Arabia, and Qatar are investing in plastic recycling infrastructure, bioplastics, and green manufacturing. Government-led awareness campaigns and private sector engagement in sustainable packaging are boosting adoption. The growing retail and e-commerce sectors are also pushing for packaging that meets both environmental standards and consumer expectations.

Africa’s sustainable plastic packaging market is growing due to increasing environmental policies, donor-funded initiatives, and strong NGO involvement. Countries like Kenya, Rwanda, and South Africa have implemented some of the strictest bans on single-use plastics globally. Rising urbanization and the need to manage plastic waste in megacities are driving investment in recycling infrastructure and alternative packaging materials. Support from international development agencies and partnerships with multinational companies are helping build capacity for local sustainable packaging production. Moreover, public awareness and grassroots movements are promoting eco-friendly consumption practices.

More Insights in Towards Packaging:

- Post-Consumer Recycled Plastic Market Growth Drivers, Challenges, Opportunities and Leading Players - The post-consumer recycled plastic market is expected to increase from USD 13.06 billion in 2025 to USD 31.91 billion by 2034, growing at a CAGR of 10.44% throughout the forecast period from 2025 to 2034.

- Recyclable Beverage Packaging Market Trends, Challenges, Strategic Recommendations & Key Players - The recyclable beverage packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation.

- AI in Sustainable Packaging Market Growth, Leading Players and Strategic Insights - The global AI in sustainable packaging market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally.

- Modified Atmosphere Packaging Trays (MAP) Market: A Fresh Solution for Food Shelf Life and Sustainability - The modified atmosphere packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation.

- Industrial Packaging Recycling Services Market: AI Integration Reshaping the Future of Sustainable Packaging - The industrial packaging recycling services market is expected to increase from USD 67.76 billion in 2025 to USD 100.65 billion by 2034, growing at a CAGR of 4.53% throughout the forecast period from 2025 to 2034.

- Smart Corrugated Packaging Market Key Players, Trends, and Forecast - The smart corrugated packaging market is forecast to grow from USD 340.06 billion in 2025 to USD 501.21 billion by 2034, driven by a CAGR of 4.40% from 2025 to 2034.

- UV Resistant Films Market Growth Drivers, Challenges, Opportunities and Leading Players - The UV-resistant films market is set to grow from USD 3.66 billion in 2025 to USD 6.37 billion by 2034, with an expected CAGR of 6.43% over the forecast period from 2025 to 2034.

- Cellulose Film Packaging Market Competitive Forces and Leading Players - The cellulose film packaging market is forecast to grow from USD 940.11 million in 2025 to USD 1532.98 million by 2034, driven by a CAGR of 5.63% from 2025 to 2034.

- Metalized Biaxially Oriented Polypropylene Films Market Key Players and Investment Trends - The metalized biaxially oriented polypropylene films market is set to grow from USD 7.74 billion in 2025 to USD 13.1 billion by 2034, with an expected CAGR of 6.05% over the forecast period from 2025 to 2034.

- Fossil-Based Plastics Market Research Insights, Key Players, Trends and Forecast - The fossil-based plastics market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation.

Segment Outlook

Material Insights

The polyethylene (PE) segment dominated the carbon credit market with the largest share in 2024. Polyethylene (PE), particularly HDPE and LDPE, is widely used in sustainable plastic packaging due to its recyclability, durability, and cost-effectiveness. It offers excellent moisture resistance, flexibility, and compatibility with existing manufacturing equipment. PE is also available in bio-based forms, reducing reliance on fossil fuels.

Its wide acceptance in recycling systems and potential for mono-material packaging support circular economy goals. Additionally, its lightweight nature lowers transport emissions, while global supply chains ensure consistent availability for sustainable packaging applications across various industries.

The bioplastics are experiencing the fastest growth in the sustainable plastic packaging market due to a combination of environmental, regulatory, and technological factors. Rising consumer awareness of plastic pollution and increasing government regulations banning single-use plastics are driving demand for eco-friendly alternatives. Bioplastics, derived from renewable sources like corn and sugarcane, offer a lower carbon footprint and reduced reliance on fossil fuels. Advances in material technology have improved their durability, barrier properties, and suitability for a wider range of applications, including food packaging and rigid containers.

Additionally, strong corporate sustainability commitments and ESG goals are pushing major brands to adopt bioplastics as part of their packaging strategies. The market is also being fuelled by significant research and development investment and growing startup activity in green packaging innovation. Moreover, some bioplastics offer compostability, enhancing their appeal to both consumers and regulators. Overall, bioplastic’s perceived environmental benefits, combined with ongoing innovation and policy support, are accelerating their adoption at an unprecedented rate.

Type Insights

The flexible packaging segment held the dominant share in the market in 2024. Flexible packaging uses significantly less material than rigid alternatives, reducing resource consumption, energy use, and carbon emissions during production and transportation. Advancements in mono-material films (e.g., all-PE or all-PP) make flexible packaging more recyclable, aligning with circular economy goals. Manufacturers are also using bio-based or compostable films to enhance sustainability.

Sectors such as food and beverage, personal care, pharmaceuticals, and household products prefer flexible packaging for its cost-effectiveness, convenience, and ability to preserve freshness. Flexible packaging offers features like resealability, portability, and portion control, which are increasingly valued by consumers seeking convenience and minimal waste.

Lower material costs, reduced shipping weight, and higher space efficiency in logistics make flexible packaging economically attractive for manufacturers pursuing sustainability. Flexible formats that are recyclable or made from recycled content are increasingly meeting Extended Producer Responsibility (EPR) and packaging compliance targets in key regions.

The rigid packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Rigid plastic packaging is growing at the fastest rate in the sustainable plastic packaging market due to its durability, recyclability, and ability to protect products effectively.

Advancements in lightweight rigid containers made from post-consumer recycled plastics and bio-based materials enhance sustainability. High demand from the food, beverage, and personal care sectors, combined with rising consumer preference for reusable and refillable packaging, supports growth. Regulatory support for recycled content and circular economy goals also drives the adoption of rigid sustainable plastic solutions.

Packaging Format Insights

The primary packaging segment dominates the sustainable plastic packaging market due to its direct role in protecting and preserving products, especially in food, beverage, pharmaceutical, and personal care sectors. This packaging ensures product safety, extends shelf life, and provides branding and regulatory information. With growing consumer demand for eco-friendly options, companies are shifting to recyclable, biodegradable, and reusable materials in primary packaging. Additionally, regulatory pressures for sustainable product labeling and waste reduction further accelerate the adoption of sustainable practices in primary packaging solutions.

The secondary packaging segment is growing at the fastest rate in the sustainable plastic packaging market due to its vital role in logistics, waste reduction, and brand positioning. The rapid expansion of e-commerce has increased demand for protective and durable packaging, making secondary packaging more important than ever. Companies are focusing on sustainable secondary packaging as a visible and cost-effective way to meet corporate sustainability goals and ESG targets. Regulatory pressure on packaging waste, especially in transport and distribution, is also pushing businesses toward eco-friendly materials.

Innovations in recyclable films, compostable plastics, and lightweight alternatives have made sustainable secondary packaging more practical and appealing. Additionally, since secondary packaging often serves as the first physical interaction a customer has with a product, especially in online retail, brands are using it to reinforce environmental values and enhance consumer perception.

Process Insight

The biodegradable process segment is dominant in the sustainable plastic packaging market due to growing environmental concerns, government regulations, and increasing demand for eco-friendly alternatives. Biodegradable packaging materials decompose naturally, reducing landfill waste and pollution. This aligns with global sustainability goals and appeals to environmentally conscious consumers.

Advances in biodegradable polymers like PLA and PHA have improved performance and broadened their applications across industries. Additionally, strong support from governments through bans on traditional plastics and incentives for green alternatives has accelerated adoption. The ability to reduce long-term environmental impact makes biodegradable packaging a preferred choice in many sectors.

The recyclable process segment is growing at the fastest rate in the sustainable plastic packaging market due to increasing regulatory pressure, consumer awareness, and advancements in recycling technologies. Governments worldwide are enforcing stricter packaging waste laws and extended producer responsibility (EPR) programs, pushing companies to adopt recyclable materials.

Consumers are also demanding packaging that is easy to recycle and environmentally friendly. Technological improvements have made sorting and recycling processes more efficient, expanding the range of recyclable plastics. Additionally, using recyclable materials supports corporate sustainability goals and helps reduce raw material costs by enabling closed-loop packaging systems.

Application Insight

The food and beverages segment holds a large share in the sustainable plastic packaging market due to high consumption rates, strict safety and hygiene standards, and growing demand for eco-friendly packaging solutions. This industry requires extensive packaging to preserve product quality, extend shelf life, and ensure safe transportation.

As consumer preferences shift toward sustainable and responsibly packaged products, food and beverage companies are adopting recyclable, biodegradable, and compostable materials. Regulatory pressure to reduce single-use plastics in food packaging further drives this transition. Additionally, large product volumes and global distribution networks make sustainability improvements in this segment highly impactful and scalable.

The healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Sustainable plastic packaging is extensively used in healthcare packaging due to its ability to meet stringent safety, hygiene, and regulatory requirements while reducing environmental impact. Key factors include its sterility and barrier properties, which protect sensitive medical products from contamination and moisture.

Sustainable plastics, like recyclable and biodegradable materials, offer biocompatibility and compatibility with sterilization processes. The growing focus on reducing medical waste and healthcare’s carbon footprint drives the adoption of eco-friendly materials. Additionally, lightweight and durable sustainable plastics reduce transportation emissions and costs, making them ideal for healthcare packaging that demands reliability and sustainability.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Global Sustainable Plastic Packaging Market:

- In January 2025, at Packaging Innovations and Empack 2025, Rottneros Packaging AB, a pioneer in thermoformed moulded pulp packaging, launched its NATURE line of eco-friendly food packaging trays.

- In September 2024, Pakka’s main brand, Chuk, introduced a new product range in its line of 100% compostable tableware in an effort to lessen the usage of single-use plastic and further its mission to create a cleaner environment. Bagasse, the agricultural leftover of sugarcane, is used to make the newest items, which include a beverage cup, a 4-inch donut, and a 3-cup snack tray.

Global Sustainable Plastic Packaging Market Players

- Amcor

- Mondi Group

- Be Green Packaging LLC

- Better Packaging

- Berry Global

- Sealed Air Corporation

- Tetra Pak

- Ball Corporation

- Uflex Limited

- DS Smith

- Elevate Packaging

- Oji Holdings

- Stora Enso

- Alpha Packaging, Inc

- Ardagh Group

- BioPak

- Calvin Klein

Global Sustainable Plastic Packaging Market

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Bioplastics

- Others

By Type

- Rigid

- Flexible

By Packaging Format

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Process

- Recyclable

- Reusable

- Biodegradable

By Application

- Food and Beverages

- Personal Care and Cosmetics

- Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5617

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Web Wire | Packaging Web Wire | Automotive Web Wire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.